All Categories

Featured

Table of Contents

It can be awkward to think of the expenditures that are left when we pass away. Failure to prepare ahead for an expense might leave your family members owing countless bucks. Oxford Life's Assurance last expenditure entire life insurance policy policy is an economical way to aid cover funeral prices and various other expenditures left.

If you decide to acquire a pre-need strategy, be sure and compare the General Rate Checklist (GPL) of several funeral homes prior to determining that to buy the strategy from. Right here are some inquiries the FTC encourages you to ask when taking into consideration pre-paying for funeral solutions, according to its pamphlet, Shopping for Funeral Providers: What exactly is included in the price? Does the price cover just product, like a casket or urn, or does it consist of other funeral services?

Life Insurance To Cover Funeral Costs

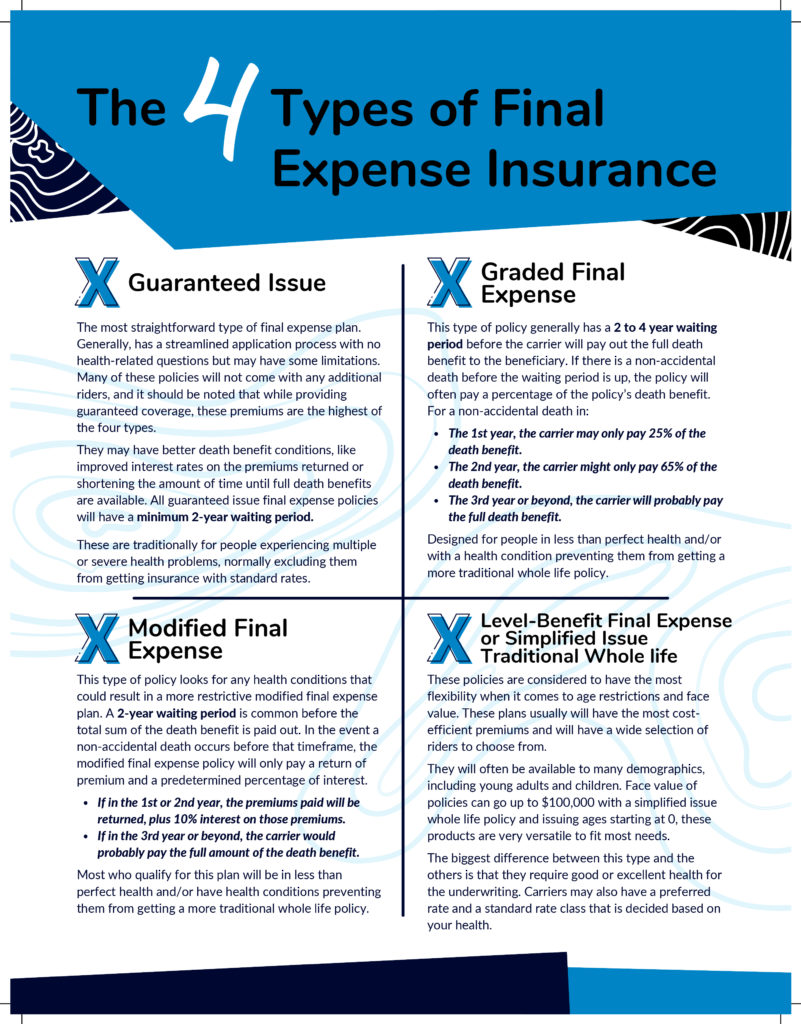

Not all plans are the same. Relying on what you desire to protect, some last cost policies may be better for you than others. Generally, most last cost insurance provider just provide a fatality advantage to your recipient. They don't supply any type of support with managing the funeral arrangements or price purchasing funeral products.

It's usual to assume your family members will use your life insurance coverage advantages to pay for your funeral costsand they might. But those benefits are meant to change lost revenue and help your household settle debtso they may or might not be used for your funeraland there can be various other difficulties, as well.

If the insurance coverage has not been used and an advantage has not been paid during that time, you may have a choice to restore it, yet often at a higher premium price. This kind of policy does not safeguard against rising funeral costs. In some cases called long-term insurance, this has a higher costs due to the fact that the advantage does not end in a certain period.

These plans remain in pressure up until the time of death, whereupon the advantage is paid completely to the marked beneficiary (funeral chapel or person). If you remain in great health and wellness or have just small wellness concerns, you might think about a medically underwritten plan. There is typically a comprehensive medical history related to these plans, however they use the chance for a greater optimum benefit.

Funeral Planning Insurance

If costs boost and come to be better than the plan's fatality advantage, your household will need to pay the distinction. A plan might have a combination of these components. For some people, a medical exam is a great barrier to obtaining entire life insurance coverage.

Medicare only covers clinically necessary costs that are needed for medical diagnosis and treatment of a health problem or problem. Funeral costs are ruled out clinically necessary and consequently aren't covered by Medicare. Final cost insurance provides a very easy and relatively low price way to cover these costs, with plan advantages ranging from $5,000 to $20,000 or even more.

State Farm Final Expense

Buying this coverage is another means to assist prepare for the future. Life insurance coverage can take weeks or months to pay, while funeral expenses can begin accumulating immediately. Although the beneficiary has last word over exactly how the money is utilized, these policies do make clear the insurance policy holder's purpose that the funds be made use of for funeral and associated expenses.

While you might not appreciate considering it, have you ever considered how you will ease the monetary concern on your enjoyed ones after you're gone? is an usually economical possibility you might desire to take into consideration. We comprehend that with many insurance options out there, understanding the different kinds can feel overwhelming.

Accidental survivor benefit: Offers a supplementary advantage if the policyholder passes away due to a crash within a specific period. Increased death advantage: Supplies a portion (or all) of the death advantage directly to the guaranteed when they are detected with a certifying incurable disease. The amount paid out will lower the payout the recipients obtain after the insured passes away.

Neither is the idea of leaving loved ones with unexpected costs or debts after you're gone. Take into consideration these 5 facts concerning last expenses and how life insurance can aid pay for them.

Caskets and burial ground stories are just the start. Event costs, transport, headstones, also clergy donations In 2023, the National Funeral service Supervisors Organization computed that the typical expense of a funeral was $9,995.1 Funeral services might be one of the most top-of-mind last cost, however many times, they're not the only one. Home utility costs and superior cars and truck or home fundings might have to be paid.

You might have developed a will certainly or estate strategy without taking into consideration last expenditure prices. Just now is it emerging that final expenditures can call for a lot economically from enjoyed ones. A life insurance policy policy may make good sense and the cash advantage your recipient obtains can help cover some financial expenses left such as on a daily basis costs and even inheritance tax.

End Of Life Expense Insurance

Your approval is based on wellness information you give or give a life insurance business permission to acquire. This short article is given by New York Life Insurance Company for informative objectives only.

Having life insurance policy provides you tranquility of mind that you're monetarily safeguarding the ones who matter a lot of. Another considerable means life insurance coverage aids your loved ones is by paying for final costs, such as funeral prices.

Last costs are the costs related to burial home fees, funeral and cemetery charges primarily any of the expenses connected with your death. The very best method to answer this inquiry is by asking yourself if your enjoyed ones could manage to pay for last expenditures, if you were to pass away, out of pocket.

You may likewise be able to select a funeral home as your recipient for your last expenditures. This alternative has a number of advantages, including preserving the right to pick where your solution will certainly be held.

Talk with your American Family Insurance Policy representative to plan ahead and ensure you have the appropriate life insurance policy coverage to secure what matters most.

Funeral Plan Insurance Quotes

Interest will certainly be paid from the day of death to date of repayment. If death is because of natural causes, death earnings will certainly be the return of premium, and interest on the premium paid will be at a yearly reliable price specified in the policy contract. This plan does not ensure that its earnings will suffice to pay for any kind of specific solution or product at the time of requirement or that solutions or goods will certainly be given by any type of particular provider.

A complete statement of coverage is located only in the plan. For more details on insurance coverage, expenses, limitations; or to make an application for protection, get in touch with a neighborhood State Farm representative. There are restrictions and conditions regarding payment of benefits as a result of misstatements on the application. Rewards are a return of premium and are based on the real mortality, expense, and financial investment experience of the Firm.

Permanent life insurance policy creates money worth that can be obtained. Plan lendings accrue passion and overdue plan financings and interest will reduce the survivor benefit and cash money worth of the plan. The quantity of cash worth available will typically depend upon the kind of long-term policy bought, the quantity of protection acquired, the length of time the plan has been in force and any kind of exceptional policy loans.

Latest Posts

Child Term Rider Life Insurance

Taxation Of Group Term Life Insurance

Funeral Insurance Nyc