All Categories

Featured

Table of Contents

Much like any type of other permanent life plan, you'll pay a normal premium for a final cost plan for an agreed-upon survivor benefit at the end of your life. Each service provider has different guidelines and alternatives, however it's relatively very easy to take care of as your beneficiaries will have a clear understanding of just how to invest the cash.

You might not need this kind of life insurance policy. If you have irreversible life insurance policy in area your last costs might already be covered. And, if you have a term life plan, you may be able to convert it to an irreversible policy without several of the added actions of getting last cost coverage.

Developed to cover restricted insurance needs, this type of insurance can be a budget friendly alternative for individuals who simply want to cover funeral prices. (UL) insurance policy stays in area for your whole life, so long as you pay your premiums.

Funeral Insurance Companies In Usa

This choice to last expenditure coverage offers choices for extra family members protection when you require it and a smaller insurance coverage amount when you're older.

Final expenses are the costs your family members spends for your interment or cremation, and for other points you may desire back then, like a gathering to celebrate your life. Thinking regarding last costs can be hard, understanding what they cost and making certain you have a life insurance coverage plan big sufficient to cover them can aid save your family an expenditure they could not have the ability to afford.

Final Expense Market

One option is Funeral service Preplanning Insurance coverage which allows you pick funeral services and products, and money them with the acquisition of an insurance plan. An additional choice is Final Cost Insurance Policy. This kind of insurance policy offers funds directly to your beneficiary to assist pay for funeral and other expenses. The quantity of your final expenditures depends on numerous points, consisting of where you reside in the USA and what type of last plans you want.

It is forecasted that in 2023, 34.5 percent of family members will select interment and a greater percentage of households, 60.5 percent, will certainly select cremation1. It's approximated that by 2045 81.4 percent of families will certainly choose cremation2. One reason cremation is becoming much more preferred is that can be less costly than burial.

Life And Burial Insurance

Relying on what your or your household desire, things like burial plots, serious pens or headstones, and caskets can boost the price. There might likewise be expenditures along with the ones particularly for funeral or cremation. They might consist of: Covering the cost of travel for family members and enjoyed ones so they can go to a service Provided dishes and other expenditures for a party of your life after the solution Purchase of special clothing for the service When you have a great concept what your final expenses will be, you can aid prepare for them with the ideal insurance coverage policy.

Medicare only covers clinically necessary expenditures that are required for the diagnosis and therapy of an illness or problem. Funeral costs are not taken into consideration medically needed and therefore aren't covered by Medicare. Final expenditure insurance coverage offers a very easy and fairly low-cost way to cover these expenditures, with policy benefits ranging from $5,000 to $20,000 or more.

Individuals usually purchase final expenditure insurance with the intention that the recipient will certainly utilize it to pay for funeral prices, arrearages, probate fees, or other relevant expenses. Funeral costs could include the following: Individuals typically ask yourself if this kind of insurance policy coverage is essential if they have financial savings or various other life insurance policy.

Life insurance policy can take weeks or months to payout, while funeral service expenditures can begin building up instantly. Although the beneficiary has the last word over exactly how the money is made use of, these plans do make clear the insurance policy holder's purpose that the funds be made use of for the funeral and related expenses. People typically buy long-term and term life insurance policy to aid offer funds for recurring expenditures after an individual dies.

Burial Insurance Reviews

The most effective means to guarantee the policy amount paid is spent where planned is to call a beneficiary (and, in some instances, a second and tertiary recipient) or to put your dreams in a surviving will certainly and testament. It is frequently a great technique to alert primary recipients of their expected tasks once a Last Cost Insurance plan is gotten.

Costs begin at $22 per month * for a $5,000 coverage policy (costs will certainly vary based on concern age, sex, and coverage amount). No clinical exam and no health and wellness concerns are required, and consumers are guaranteed insurance coverage with automatic qualification.

Below you will locate some frequently asked inquiries must you pick to use for Final Cost Life Insurance Coverage by yourself. Corebridge Direct certified life insurance policy agents are waiting to address any extra inquiries you could have relating to the defense of your enjoyed ones in the occasion of your passing away.

The kid cyclist is acquired with the notion that your youngster's funeral expenses will certainly be totally covered. Kid insurance policy riders have a fatality benefit that varies from $5,000 to $25,000.

Final Expense Insurance Definition

Note that this policy only covers your youngsters not your grandchildren. Final expense insurance plan benefits do not end when you join a plan.

Bikers are available in various forms and offer their own benefits and motivations for signing up with. Bikers are worth checking out if these additional options put on you. Cyclists consist of: Faster death benefitChild riderLong-term careTerm conversionWaiver of premium The sped up survivor benefit is for those who are terminally ill. If you are critically unwell and, depending upon your certain plan, determined to live no longer than six months to two years.

The drawback is that it's going to reduce the death benefit for your beneficiaries. The child biker is bought with the notion that your child's funeral service expenses will certainly be totally covered.

Protection can last up until the kid turns 25. The long-lasting treatment motorcyclist is comparable in principle to the accelerated fatality advantage.

Final Expense Insurance Near Me

This is a living advantage. It can be obtained against, which is really helpful since long-lasting care is a significant expense to cover.

The motivation behind this is that you can make the button without undergoing a medical test. And given that you will no much longer be on the term policy, this additionally indicates that you no longer need to fret about outliving your policy and shedding out on your survivor benefit.

Those with existing health conditions may come across higher premiums or limitations on insurance coverage. Maintain in mind, policies typically cover out around $40,000.

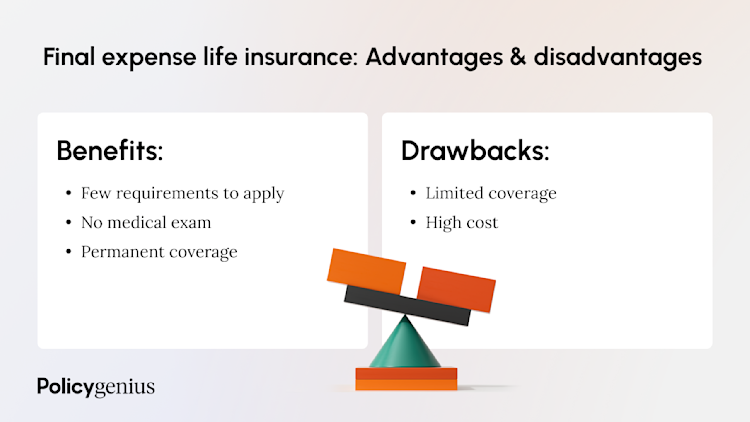

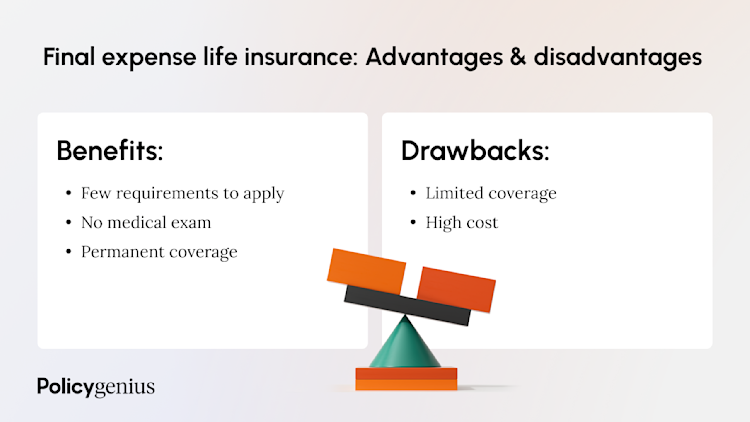

Take into consideration the month-to-month premium payments, however additionally the tranquility of mind and monetary safety and security it provides your family members. For many, the peace of mind that their liked ones will not be strained with financial difficulty throughout a hard time makes last cost insurance coverage a worthwhile financial investment. There are two sorts of last expenditure insurance:: This kind is best for individuals in reasonably health that are trying to find a means to cover end-of-life costs.

Insurance coverage amounts for simplified concern plans commonly rise to $40,000.: This kind is best for people whose age or health and wellness avoids them from getting other types of life insurance policy coverage. There are no health demands in any way with assured concern policies, so anyone who meets the age demands can normally certify.

Below are a few of the factors you must take into account: Evaluate the application procedure for different plans. Some may need you to address wellness inquiries, while others provide ensured concern choices. See to it the service provider that you choose offers the amount of coverage that you're looking for. Look right into the settlement alternatives offered from each carrier such as month-to-month, quarterly, or yearly costs.

Latest Posts

Child Term Rider Life Insurance

Taxation Of Group Term Life Insurance

Funeral Insurance Nyc