All Categories

Featured

Table of Contents

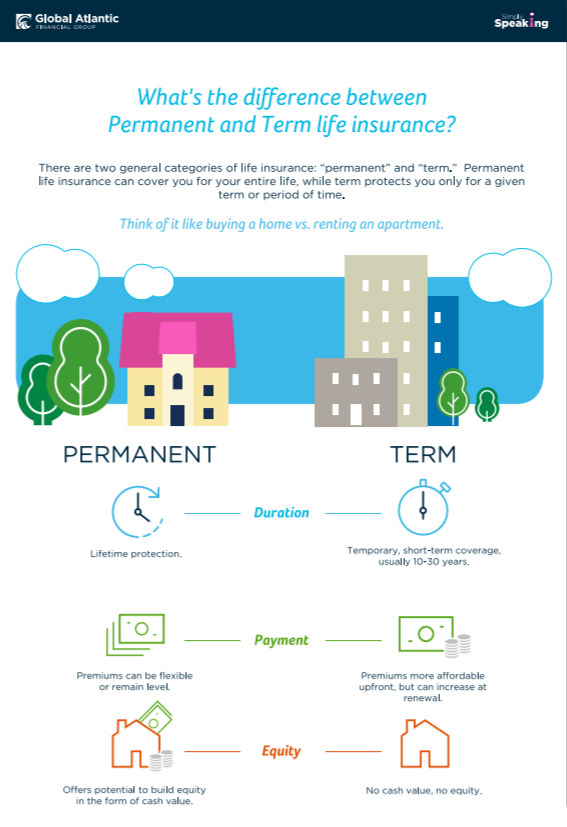

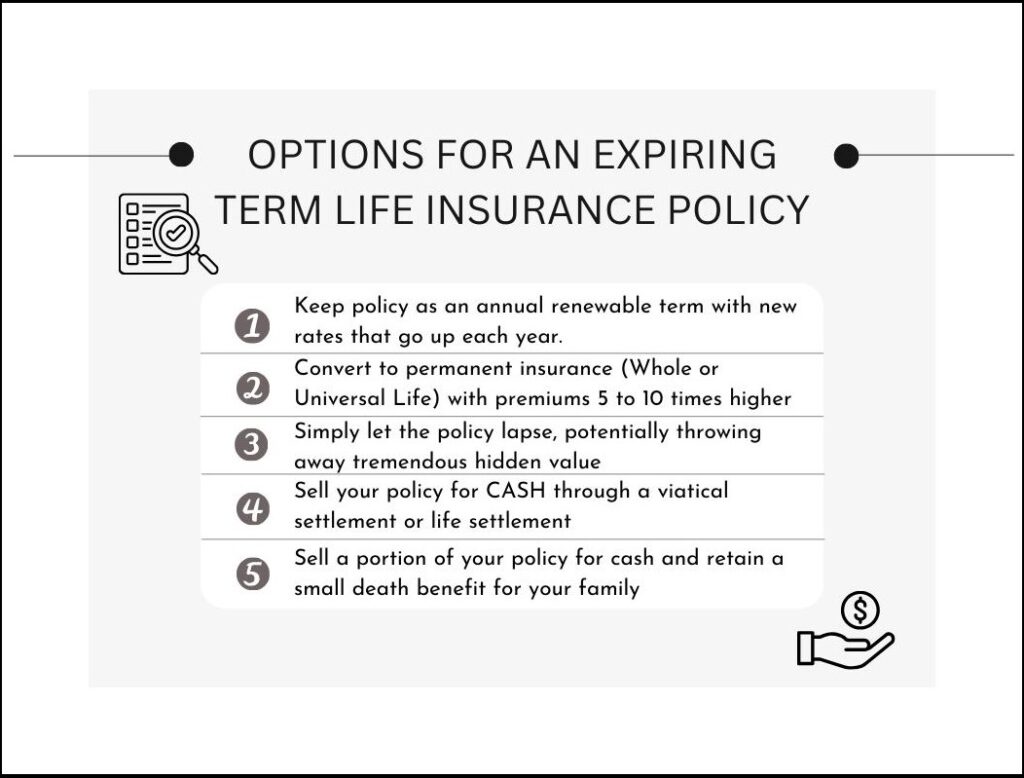

There is no payment if the plan ends before your fatality or you live beyond the policy term. You may have the ability to renew a term policy at expiry, but the premiums will certainly be recalculated based on your age at the time of revival. Term life insurance coverage is normally the the very least expensive life insurance coverage offered because it provides a survivor benefit for a limited time and doesn't have a cash money value element like irreversible insurance coverage.

At age 50, the premium would certainly climb to $67 a month. Term Life Insurance policy Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for males and ladies in outstanding wellness.

Life Insurance Level Term Or Decreasing

The decreased risk is one factor that enables insurers to bill reduced costs. Rate of interest, the financials of the insurance provider, and state regulations can likewise impact costs. As a whole, firms frequently supply much better prices at the "breakpoint" insurance coverage degrees of $100,000, $250,000, $500,000, and $1,000,000. When you think about the quantity of coverage you can obtain for your costs bucks, term life insurance policy tends to be the least costly life insurance coverage.

He buys a 10-year, $500,000 term life insurance plan with a costs of $50 per month. If George dies within the 10-year term, the plan will certainly pay George's recipient $500,000.

If George is diagnosed with a terminal disease throughout the very first policy term, he probably will not be eligible to renew the plan when it expires. Some policies offer guaranteed re-insurability (without proof of insurability), yet such functions come with a greater expense. There are several kinds of term life insurance policy.

Most term life insurance has a level premium, and it's the type we have actually been referring to in many of this write-up.

Best Term Life Insurance Malaysia

Term life insurance policy is eye-catching to young people with youngsters. Moms and dads can obtain significant coverage for an inexpensive, and if the insured dies while the plan holds, the household can count on the survivor benefit to replace lost income. These policies are likewise fit for individuals with expanding family members.

The right choice for you will certainly depend on your needs. Below are some things to consider. Term life policies are ideal for people that want substantial coverage at a low expense. Individuals that possess whole life insurance policy pay more in costs for much less insurance coverage yet have the safety of recognizing they are safeguarded for life.

The conversion biker should enable you to convert to any kind of long-term policy the insurer uses without restrictions - which of the following best describes term life insurance. The primary attributes of the biker are keeping the initial health ranking of the term policy upon conversion (even if you later have health problems or come to be uninsurable) and determining when and just how much of the protection to transform

Naturally, overall premiums will increase considerably considering that entire life insurance policy is extra expensive than term life insurance coverage. The benefit is the guaranteed authorization without a medical test. Medical conditions that create during the term life period can not create premiums to be boosted. Nonetheless, the business may require restricted or complete underwriting if you wish to add additional bikers to the new policy, such as a long-lasting care rider.

Whole life insurance comes with significantly greater monthly premiums. It is implied to give protection for as lengthy as you live.

Is Voluntary Life Insurance Whole Or Term

Insurance companies set an optimum age restriction for term life insurance plans. The premium additionally increases with age, so an individual aged 60 or 70 will pay significantly more than someone years younger.

Term life is somewhat similar to car insurance. It's statistically unlikely that you'll require it, and the costs are cash away if you do not. However if the most awful takes place, your family will get the advantages.

This policy style is for the client who requires life insurance policy yet would love to have the capability to pick just how their cash worth is spent. Variable plans are underwritten by National Life and dispersed by Equity Services, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Coverage Firm, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 honor details, see Irreversible life insurance policy establishes money worth that can be obtained. Plan financings accumulate passion and overdue plan lendings and interest will certainly lower the death benefit and cash worth of the policy. The amount of cash worth readily available will typically depend on the type of long-term plan bought, the amount of insurance coverage purchased, the size of time the policy has been in pressure and any type of exceptional policy car loans.

What Does Level Term Life Insurance Mean

Disclosures This is a basic summary of protection. A total statement of coverage is discovered only in the policy. For more information on protection, prices, constraints, and renewability, or to get protection, call your neighborhood State Farm representative. Insurance coverage and/or linked motorcyclists and features may not be offered in all states, and policy conditions might differ by state.

The major differences between the various sorts of term life plans on the marketplace involve the size of the term and the protection quantity they offer.Level term life insurance policy features both degree premiums and a level survivor benefit, which indicates they stay the exact same throughout the period of the plan.

It can be renewed on a yearly basis, but premiums will enhance whenever you restore the policy.Increasing term life insurance coverage, additionally called an incremental term life insurance plan, is a policy that features a death advantage that raises with time. It's usually more intricate and costly than degree term.Decreasing term life insurance policy features a payment that reduces in time. Common life insurance policy term lengths Term life insurance policy is affordable.

The main differences between term life and whole life are: The size of your insurance coverage: Term life lasts for a collection period of time and after that runs out. Ordinary monthly entire life insurance coverage rate is calculated for non-smokers in a Preferred wellness classification, getting a whole life insurance plan paid up at age 100 supplied by Policygenius from MassMutual. Aflac offers many lasting life insurance coverage plans, including whole life insurance, last cost insurance coverage, and term life insurance.

Latest Posts

Child Term Rider Life Insurance

Taxation Of Group Term Life Insurance

Funeral Insurance Nyc